Leading UK Banking App Redesign

The client: International bank, that serves 16 million customers in the UK.

Key challenge: Overhaul of the “outdated” app, to succesfully compete against the “challenger” banking solutions.

Team: Wide 30+ people team, including various roles and stakeholders, smaller 5 designer team, that I led in my role - Lead UX Designer.

Year: 2024

The bank serves 16 million customers in the UK, but its outdated app failed to meet the needs of vulnerable users — especially compared to modern challenger banks like Monzo.

But not anymore.

I led the redesign of the app and designed new features focused on fraud prevention and detection,as well as collaborate with other squads on the biggest bank’s app redesign since 2012.

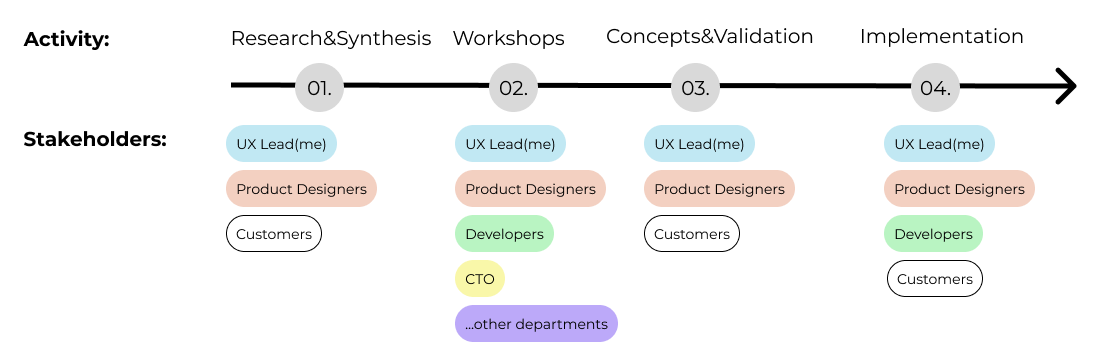

Team set-up.

Overall, there were 5 squads for the new app redesign, as it is a large bank, with a complex app. During the process, I closely collaborated also with the other squads, in order to assure app synchronicity and alignment.

01. Research and Synthesis

As the first step, I set to conduct conduct a thorough research. It consisted of:

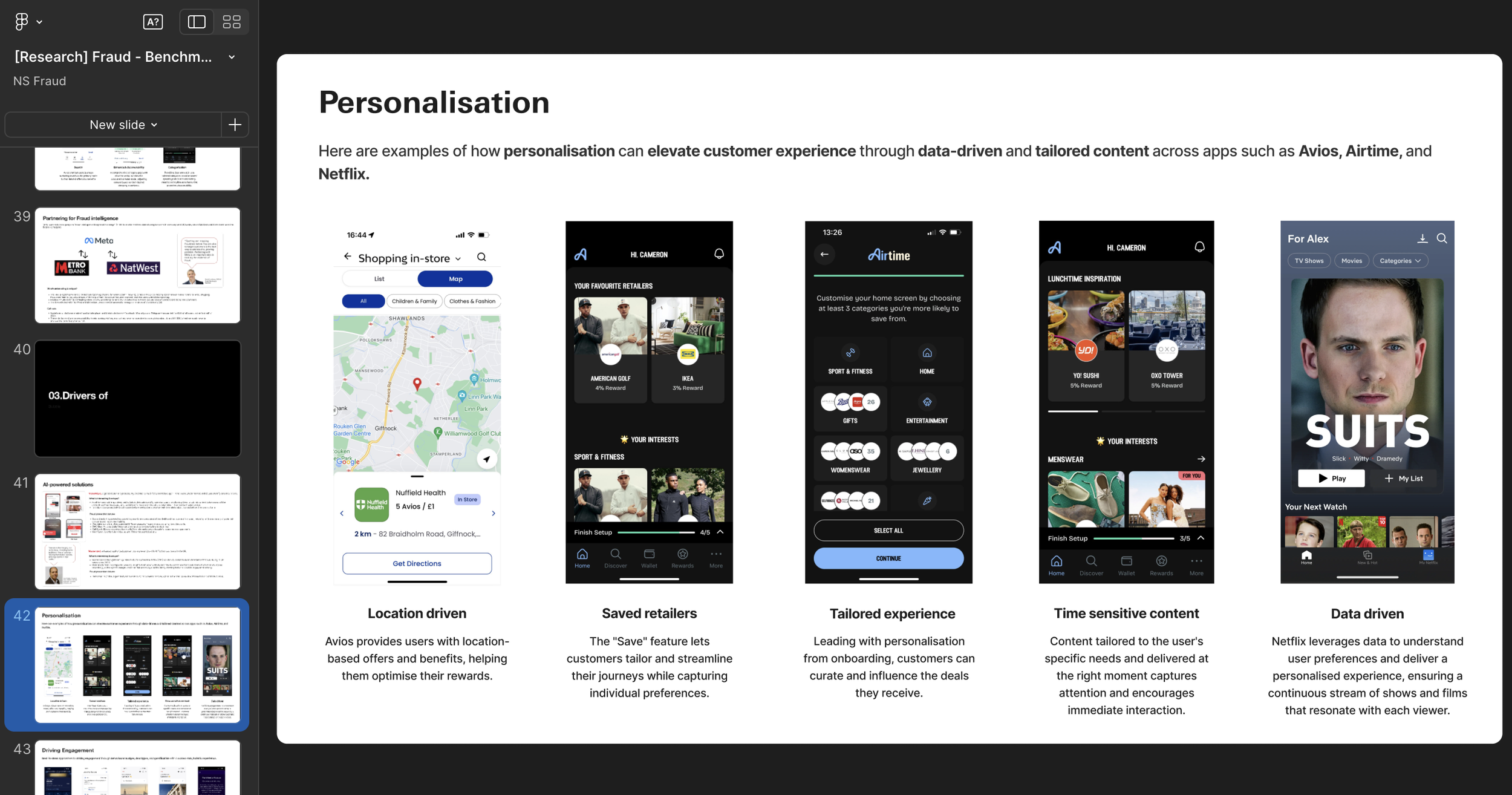

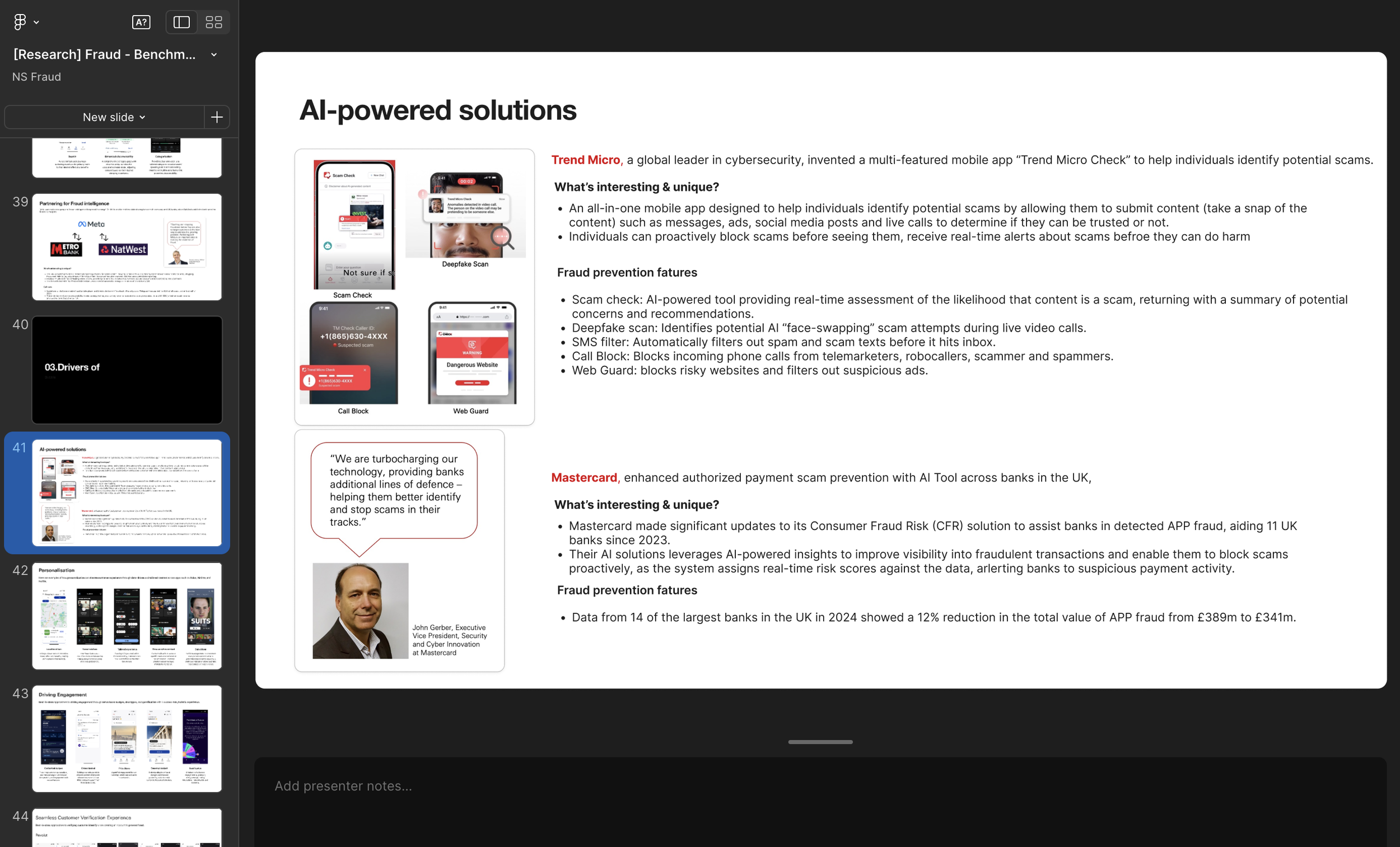

Competitor analysis, benchmarks.

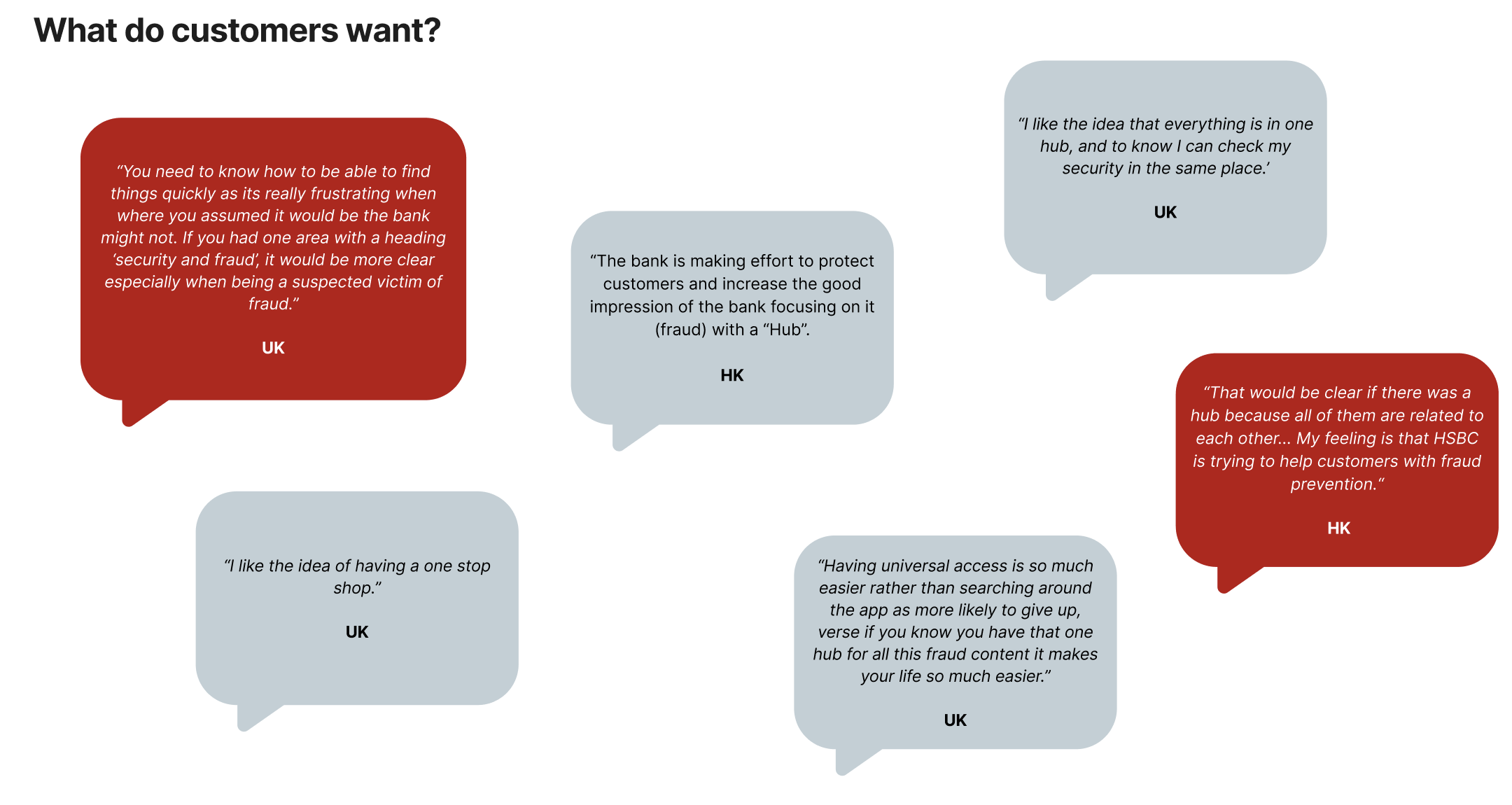

Customer interviews, field studies.

Interviews with fraud specialists.

Desk research.

What it means for the customer to be a victim of the fraud? What other solutions are out there?

The customer goes under different stages during a fraud event, and from there on it was decided to build the fraud solutions arount these different stages, to support our customers the best way.

02. Co-creation Workshops

Crucial part of the process was creative workshops, that allowed to come up with creative concepts and involve wide variety of different stakeholders in the design process.

The results:

25 concept ideas, in order to improve user end-to-end experiences in fraud.

Discovery process outcomes:

25

Ideas

6

Concepts

1

Unified hub

2

Workshops

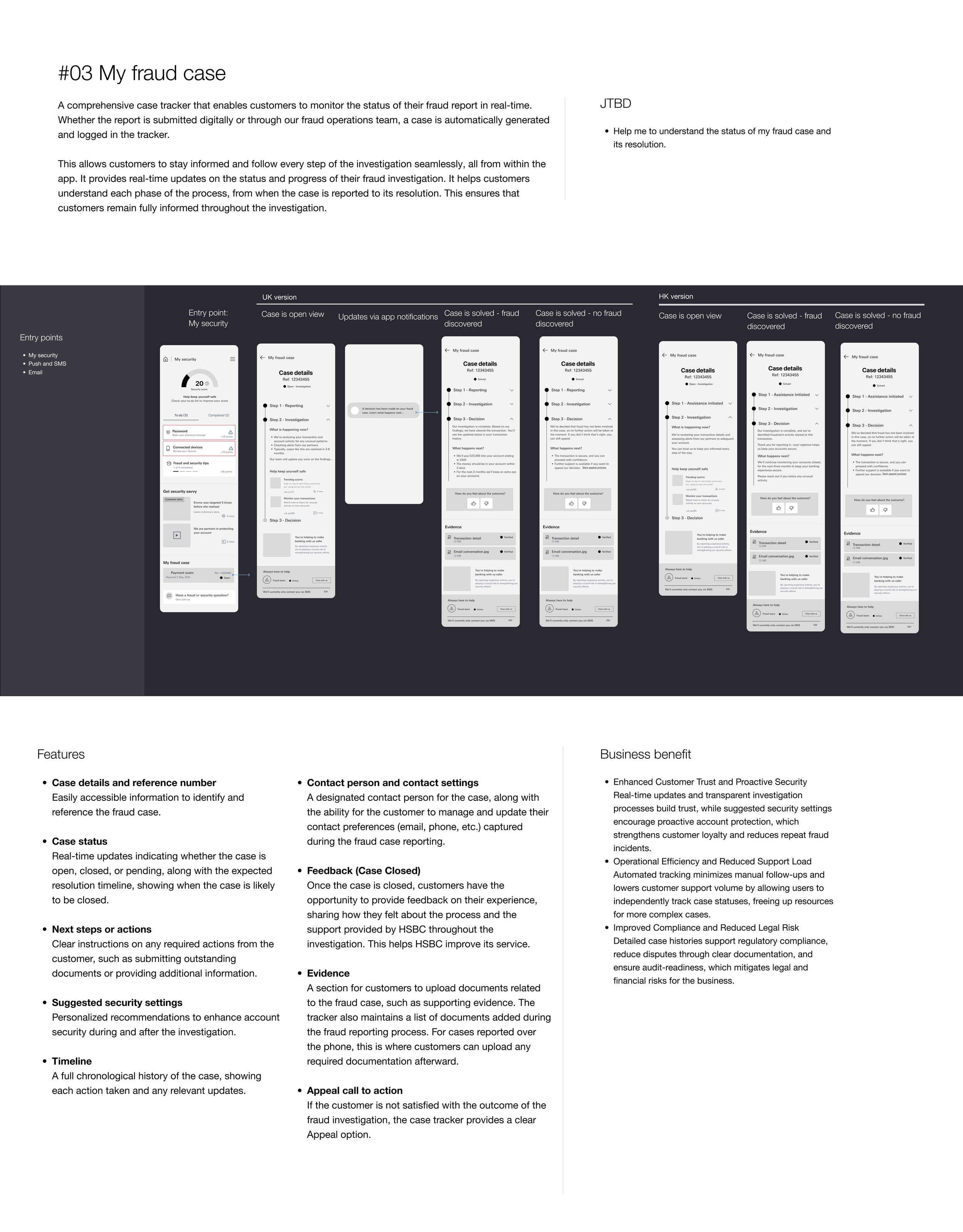

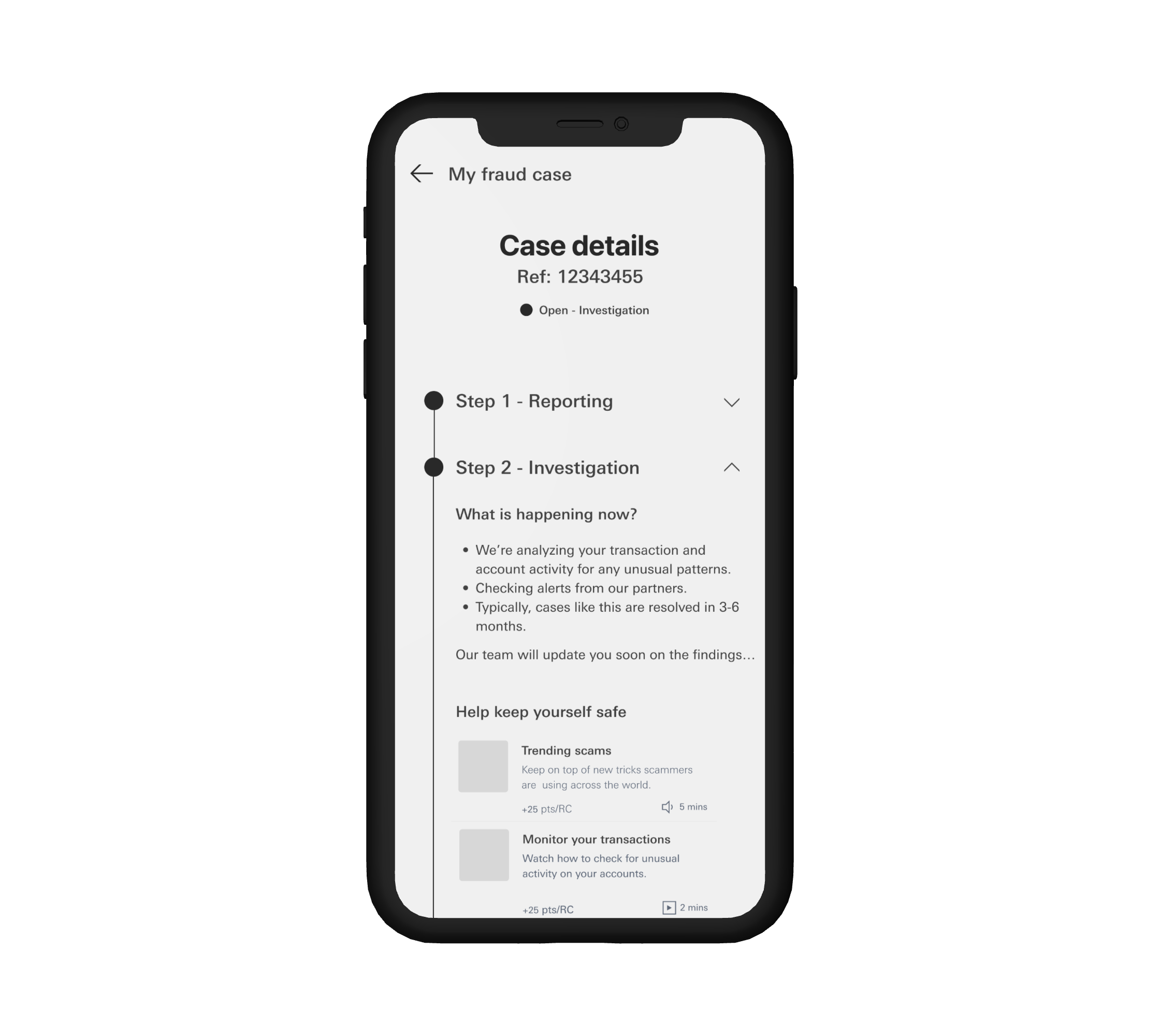

04. Concepts & Validation

The next step, was to refine the concepts - both in a more tangible format, as well as what would be the entry points, features, as well as business benefit.

In this step a total of 6 concepts were developed, with close attention to the entry points(how it would work and fit in the larger picture), as well as features and business benefit.

The concepts wireframes were tested with users, to understand the users preferences.

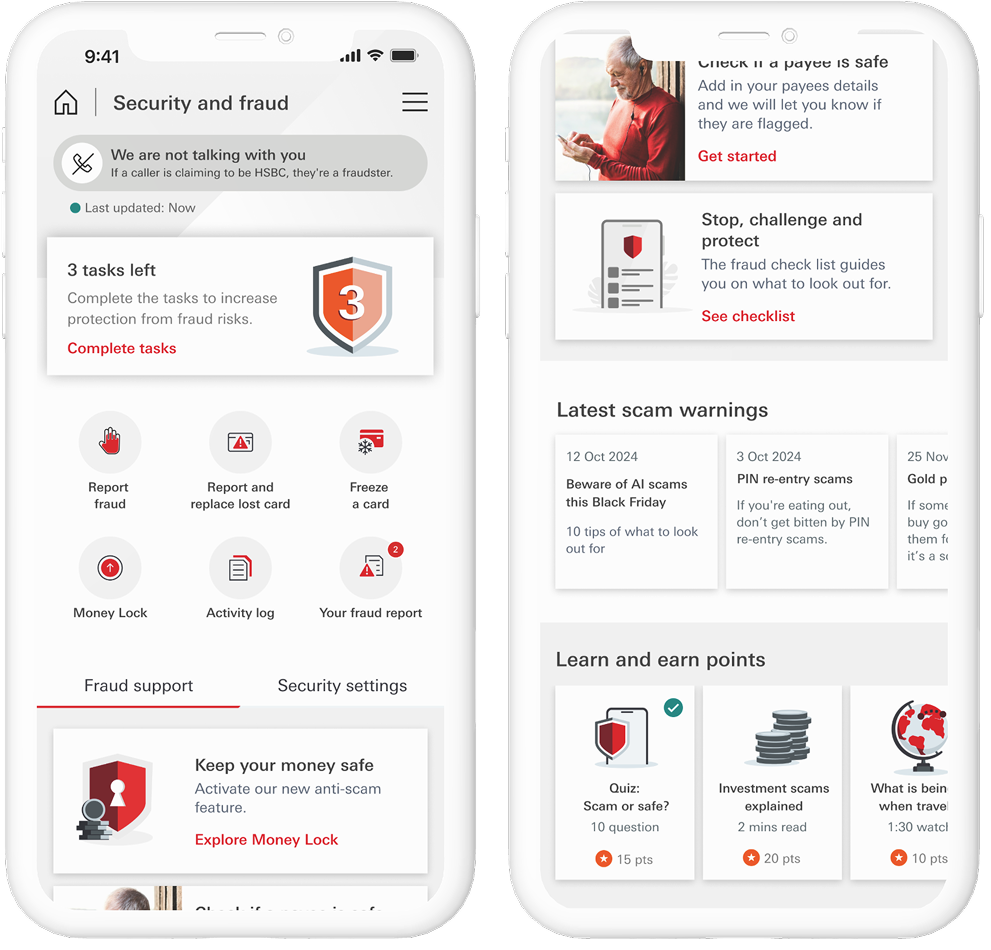

05. Implementation

During the implementation phase, it was important to understand how the new concepts could integrate and work together, as new functionalities in the app flows.

It was important to untangle, how we can turn these concepts in life.

Part of the implementation was the unified hub, that serves as a one-stop place for the users, to learn about fraud.

In close collaboration with developers these concepts could be brought to life, with on-going involvement of the customers/users to assure the best experience.

During the process, I lead the other designers and managed tasks, whilst also leading process of my own tasks, by using Kanban/Project management.

Multiple new components were introduced to the existing design system, as a part of the process.

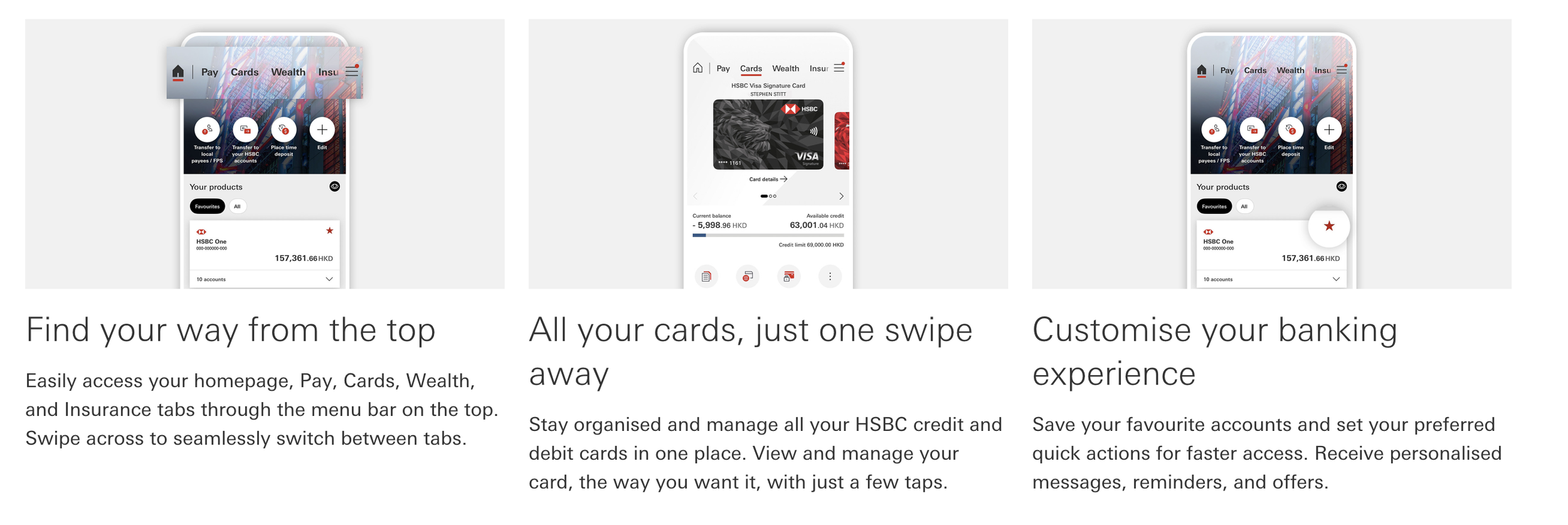

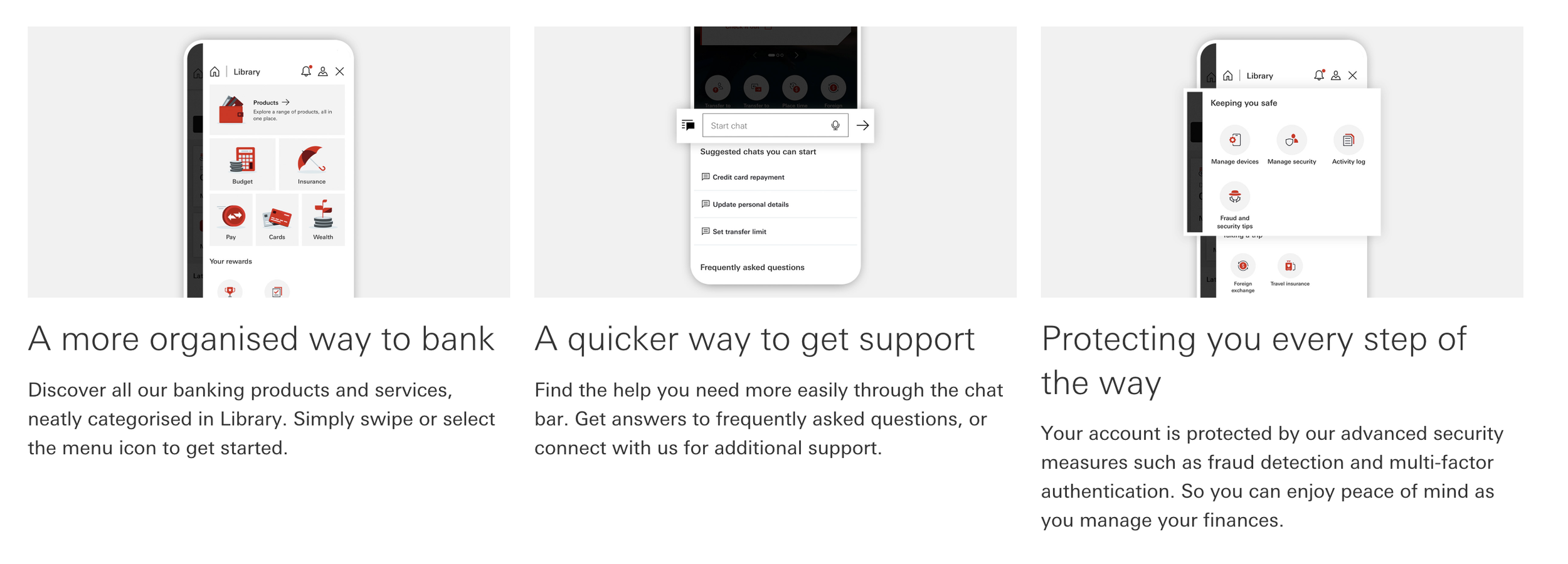

Redesign overview

Here is a comprehensive overview of the app redesign - the biggest overhaul of the banks app, since 2012. The new design is customisible, easy to navigate, as well as keeps all its customers safe, with the new anti-fraud features.

Feedback

“Elizabete led the fraud squad with clarity and ownership. She quickly aligned the team around a shared vision, turning a complex and sensitive domain into a user-centered, compliant, and intuitive experience — while also supporting other squads in aligning their work to the broader app vision.”